How banks create money “out of thin air” and the dilemmas this causes

Interestingly, the question of “Where does money actually come from?” is rarely discussed in education, despite money playing a crucial role in almost all aspects of our lives. Most people believe that money is created by the government, but that’s not entirely accurate. Governments are responsible for producing physical forms of money, such as coins and banknotes.

In reality, the majority of money is created in vast quantities by commercial banks. Many people think that these banks lend out money received from savers, which is an easy concept to grasp. However, this is not the case. The truth is that commercial banks create money “out of thin air” and then lend it out, not from the bank’s profits or deposits from savers but based on the promise that the borrower will eventually repay their loan.

The borrower’s signature on the loan contract represents an obligation to repay the bank, including the loan amount and interest. If the borrower fails to repay, they can lose their home, car, or any other assets they’ve provided as collateral. This is a significant commitment for borrowers.

So, what does the bank’s signature require? The bank “creates” the loan amount and adds it to the borrower’s account. But isn’t it incredible that banks can simply create money “out of thin air”? Yet, this is how modern banking works. This blog post explains how this system developed, how the modern monetary system works, and the dilemmas it causes.

How the Banking Sector Emerged

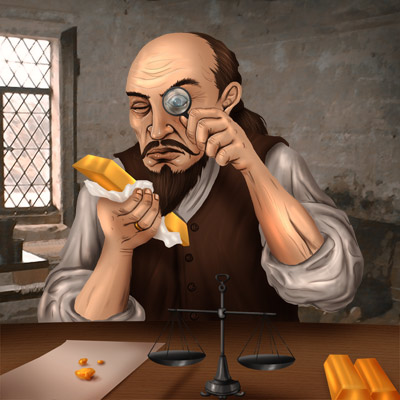

The story of the goldsmith

At various points in our history, various items were used as money, with portability and trust being the most critical factors. People used shells, cocoa beans, beautiful stones, feathers, and even gold and silver, which were preferred for their attractiveness, malleability, and ease of use. Goldsmiths made trade easier by minting coins with fixed weights and purities.

To safeguard his gold, the goldsmith needed a vault. Soon, his fellow villagers came to his door, interested in renting space to securely store their gold. Eventually, the goldsmith rented out every spot in his house and earned a small income from his vault rentals.

Years passed, and the goldsmith made a discovery: the “renters” almost never came to collect their physical gold, and they never came all at once. This was because the paper certificates the goldsmith had written as proof of ownership of the gold were traded in the market as if they were gold themselves. These paper certificates were easier to trade than heavy coins, and their quantities could easily be recorded, instead of counting every coin for each transaction.

Then, the goldsmith had a new idea. Since he had surplus gold from his vault rentals, he might as well lend out some of his gold with interest. Suddenly, he had a second source of income.

As paper certificates became more widely accepted, more and more people requested loans in the form of paper certificates rather than physical gold. As industries expanded, more and more people asked the goldsmith for loans, which gave him an even better idea.

He knew that very few of his “renters” ever came to pick up their gold from the vault. So, the goldsmith realized he could lend out the paper certificates for the gold belonging to his “renters” in addition to renting his own gold. As long as the loans were repaid, the “renters” were unaware, and they didn’t lose anything. The goldsmith, now more of a banker than a craftsman, made much more profit than he ever could by only lending his own gold.

For years, the goldsmith secretly earned income from the interest on his renters’ gold. Eventually, he became much wealthier than his fellow villagers. People suspected he was spending his depositors’ money. The depositors gathered and threatened to withdraw their gold from the vault unless the goldsmith explained his newfound wealth.

Surprisingly, this turned out well for the goldsmith. Despite his double-dealing with the vault’s value, his idea worked. He had only issued paper certificates based on the gold in the vault. The depositors hadn’t lost any gold; it was safely stored in the goldsmith’s vault.

Instead of retrieving their gold, the depositors demanded that the goldsmith, now their banker, pay them a portion of the interest earned. This marked the beginning of banking as most people know it.

The banker paid a low interest rate on the depositors’ gold and lent it out at a higher rate. The profit came from the difference, covering daily expenses and generating profit. The logic of the system was simple, and it seemed like a good solution to the need for credit.

However, this is not how banking works today.

The banker was not satisfied with the income left after sharing it with the depositors. The demand for credit increased rapidly, but his loans were limited to the amount of gold his depositors brought to the vault.

Then, the banker had a much bolder idea. Since no one, except himself, knew what was in the vault, he could write checks for gold that didn’t even exist!

If the holders of the checks didn’t all demand real gold, how would anyone ever find out? This new plan worked fantastically, and the banker became exceptionally rich from the interest payments on gold that didn’t exist.

The idea that a banker could create money “out of thin air” was too incredible to take seriously. So, for a long time, no one thought of it. But the ability to create money out of nothing eventually went to the banker’s head.

Over time, massive loans and his immense wealth raised suspicion again. Some borrowers began to ask for real gold instead of ownership certificates. Rumors circulated. Suddenly, wealthy depositors appeared, wanting their gold. The game was over.

A sea of people with ownership certificates gathered in front of the bank’s closed doors. Unfortunately, the banker didn’t have enough gold and silver to provide everyone with a claim.

This is called a bank run, and it’s something every banker fears. This phenomenon meant the end of individual banks and, unsurprisingly, damaged the public’s trust in all bankers.

Banning the idea of creating money “out of thin air” would have been a logical response. But the vast amount of credit that bankers offered was essential for economic prosperity.

So, instead of banning it, creating money this way was legalized and regulated. Bankers committed to limits on the amount of “fictional money” they could lend out. The limit would still be a much higher number than the actual amount of gold in the vault.

A commonly used ratio was 9 fictional dollars to 1 real dollar in gold. These limits were enforced through unannounced inspections. It was also decided that, in the event of a “bank run,” central banks would support local banks with emergency injections of gold. Only if many “bank runs” occurred simultaneously would the credit bubble burst, and the entire system would collapse.

How the Modern Monetary System Works

Over the years, the fractional reserve banking system, supported by several commercial banks and a central bank, has become the dominant monetary system worldwide. At the same time, the amount of gold backing this system has gradually diminished.

The fundamental nature of money has changed. In the past, a paper dollar was a “claim check” that could be exchanged for a certain amount of gold or silver. Today, a paper or digital euro can only be exchanged for another paper or digital euro.

In the past, the total amount of money was equivalent to the actual, physical quantity of the underlying good used as money. For example, to make money from gold or silver, gold or silver had to be found and mined.

Today, most money is digital. This “digital” money is created when someone takes on debt at the bank. Once the borrower signs a debt agreement, the bank, with a few keystrokes on the computer, creates the money in the customer’s account. This process is referred to as money creation.

Granting credit creates money. The more debt there is, the more money is created. But does this mean that a commercial bank can create money indefinitely?

No, because the bank must adhere to certain ratios: the liquidity ratio and the solvency ratio. Creating new money reduces these ratios. Their decline serves as a limit on money creation because they are subject to minimum thresholds.

There is another crucial restraint on money growth – the demand for money. If people don’t want to take out loans or pay off existing ones, the bank has no direct control over this. However, the bank can indirectly influence people’s borrowing behavior by changing interest rates. This is why banks respond to economic activity with some delay.

These rules don’t apply to central banks. They have no external limits on creating money. They can literally create money without constraints. This money is referred to as base money.

If there is a government deficit, the central bank can create new base money and lend it to the government at an interest rate. The lent base money is then put into circulation through government spending.

The creation of new base money also boosts the reserves of commercial banks, affecting the liquidity ratio and solvency ratio. This allows banks to lend more credit and create more money than just the base money lent by the central bank. So when money is created by a central bank, commercial banks can build on top of it.

This is a significant reason why many people still don’t trust the banking system today. Moreover, the concept is considered unfair by some. Why should banks be able to create money out of thin air and profit from it? In times of financial crisis, the economic system raises many questions.

All this turmoil during financial crises makes people want to hoard their (savings) money in paper currency. This forces banks to hold a larger buffer of paper money to prevent a bank run. In such a case, the money supply in circulation could quickly shrink. The central bank must then rapidly increase bank reserves by printing paper money. In this situation, it’s useful that the central bank can create unlimited money without any rules. However, it’s a tricky situation because excessive money creation by the central bank can lead to inflation (the devaluation of money).

These reasons contribute to why some people want to return to a gold or silver standard for the money supply. A connection to a precious metal ensures an automatic restraint on the total amount of money.

On the other hand, a gold or silver-based monetary system cannot be adjusted to accommodate economic growth. This can lead to deflation (increased money value) when there’s a shortage of gold or silver, or, in the case of a new discovery of gold or silver, a sudden influx of extra money into the economic system, which can result in inflation (money devaluation).

For these reasons, a gold-based banking system no longer seems suitable in today’s world. But that doesn’t mean our current economic system is ideal. In fact, there are several dilemmas caused by money creation from debt, as mentioned below.

Some Dilemmas Caused by Modern Banking

Dilemma 1: The Continuous Pursuit of Growth Harms People and the Planet

Banks essentially create the loan amounts, or the “principal.” What they don’t create is the money to make interest payments. However, almost all money in the money supply has been created in the same way: as bank credit that must be repaid with more than what was created.

So, borrowers everywhere find themselves in the same situation, seeking money to repay both the principal and interest, which only includes the principal. Clearly, it’s impossible for everyone to repay the principal plus interest because it simply doesn’t exist.

The problem is that for long-term loans, like mortgages and government debts, the total interest amount exceeds the principal. Therefore, the economy can only function if additional money is created to pay interest.

Every time, more and more new debt money must be created to meet the current demand for money and, by extension, to pay off old debts. This increases the overall amount of debt, leading to an ever-growing spiral of money.

When the money supply grows, money also becomes less valuable unless the amount of production and trade in the real world increases in tandem. This is not realistic; the world simply cannot produce more and more every year. Resources are finite, and the environment falls into severe imbalance. We cannot continue building an economic system with an unstable foundation.

Dilemma 2: The Rich Get Richer, and the Poor Get Poorer

The second problem of the system is that it results in a shift of wealth from the poorest 80% of the population to the richest 10% of the population through the workings of interest (the other 10% pay and receive approximately equal amounts of interest).

The total debt of the government, businesses, and individuals in the Netherlands is 2,380 billion euros. When divided per Dutch person, each person indirectly carries an average of 7,125 euros in interest costs annually (at an interest rate of 5%).

To benefit from the economic system, you must capture more than 7,125 euros in interest from your income. If this is calculated based on a positive interest rate of 3%, you need an equity of around 240,000 euros, without any personal debts, of course, to break even with the amount of interest that each Dutch person indirectly pays each year.

If you earn more than 240,000 euros, you benefit from the interest system’s operation. The operation of this mechanism is currently causing the systematic erosion of the middle class in the US and Europe. The rich get richer, and the poor get poorer due to the impact of interest.

Conclusion: The Current Form of Money Creation is not Ideal

The modern banking system emerged about 300 years ago when the Bank of England was granted permission to lend gold certificates at the modest fractional ratio of 2:1. However, that modest ratio was just the proverbial foot in the door. The system is now global and creates billions of euros daily from debt.

Whether we go left or right, with the current modern banking system, we run into a dead end. The relentless pursuit of economic growth leads to reduced well-being, a deteriorating environment, and recurring economic crises. Furthermore, the interest mechanism results in wealth imbalances, where a significant portion of society becomes poorer, and wealthy people get richer. This not only raises ethical concerns but also fosters tensions and societal instability, especially during financial crises.

What’s the solution? Regrettably, I don’t possess an answer to that question. This, in essence, underscores the issue at hand – we haven’t formulated a superior system as of yet. Crafting a solution is not a quick process; rectifying such a significant flaw requires time. Nonetheless, the process of change commences with recognizing the problem, and this is the motivation behind my authoring this article. Should you have any further inquiries, please don’t hesitate to contact me via the provided contact form. Additionally, you’ll find an informative video on the foundational principles of economics below. Until the next entry on my blog! 😉

Sources:

- Money as Debt I by Paul Grignon

- Money creation in the modern economy by Michael McLeay, Amar Radia en Ryland Thomas